Wealth Trading System - User Guide

Your guide to automated funding rate arbitrage trading

Welcome to the Wealth Trading System! This documentation will help you get started and make the most of the platform.

Quick Navigation

Supported Exchanges

| Exchange | Funding | Max Leverage |

|---|---|---|

| Binance Futures | 8h | 125x |

| Bybit Perpetuals | 8h | 100x |

| HyperLiquid | 1h | 50x |

| Aster Futures | 4-8h | 125x |

Strategy & Trading

- Trading Strategy - How the bot generates profits

- Strategy Formulas - Mathematical models and calculations

Getting Started

- Quick Start Guide - Installation, setup, and first run

- Practical Examples - Real-world workflows and use cases

- Configuration Guide - Settings and environment variables

- CLI Reference - Command-line interface documentation

- HTTP API Reference - REST API for automation

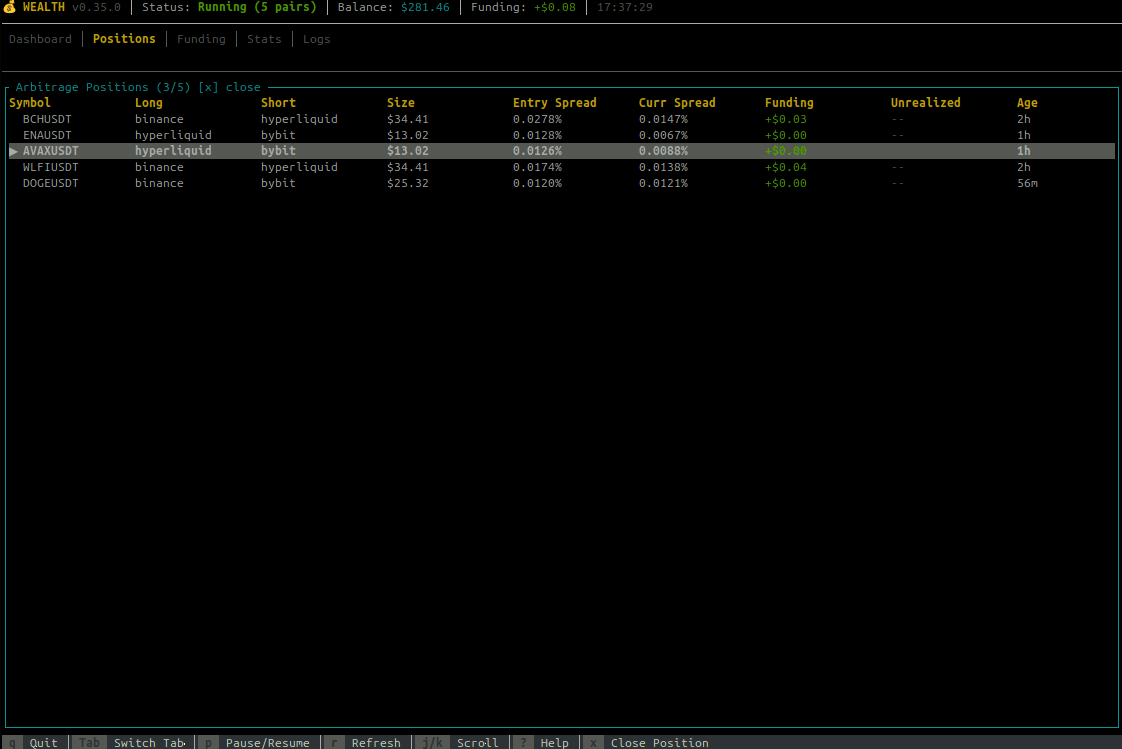

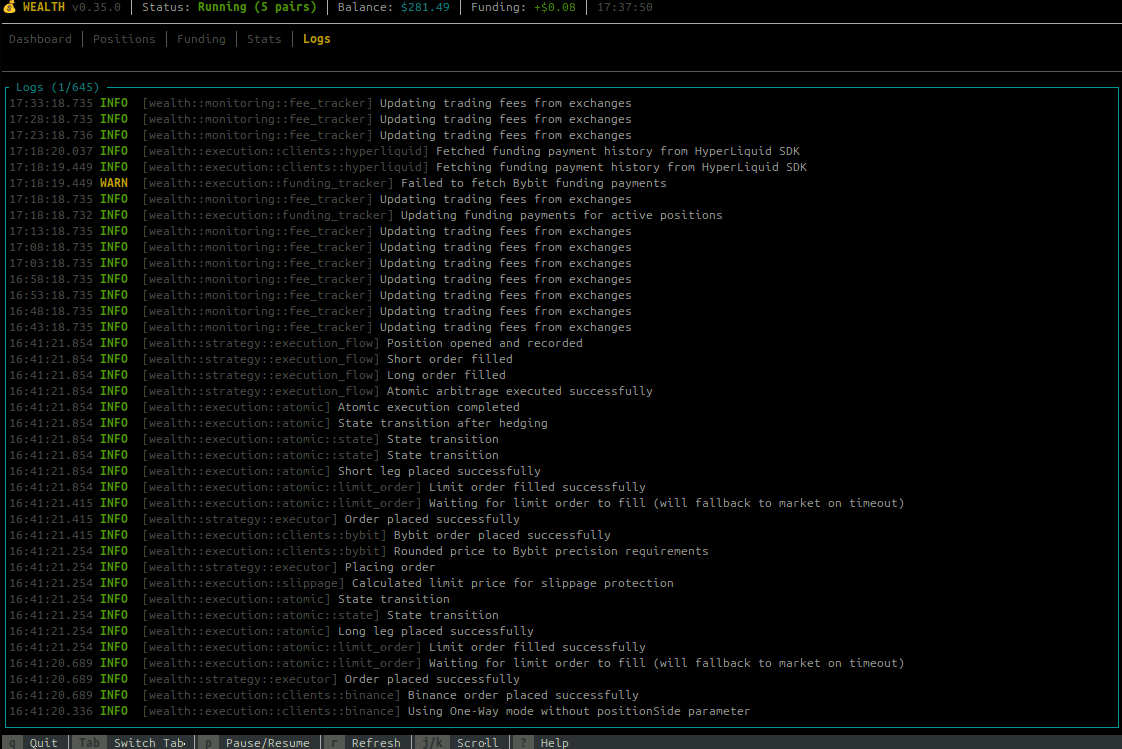

- TUI Dashboard - Interactive terminal interface

Monitoring & Operations

- Monitoring & Metrics - Prometheus, Grafana, and observability

- Grafana Cloud Setup - Cloud monitoring configuration

- Log Collection - Centralized logging with Loki

- Hot-Reload - Live configuration updates

Deployment & Security

- Deployment Guide - Production deployment and Docker

- Security & Credentials - Keeping your system secure

Help & Support

- FAQ - Frequently asked questions

- Troubleshooting - Common issues and solutions

- Licensing - License information

Quick Reference

| Task | Where to Look |

|---|---|

| First-time setup | Quick Start Guide |

| API key setup | Security Guide |

| Strategy tuning | Configuration Guide |

| Monitor trades | Monitoring Guide |

| Automate with scripts | HTTP API Reference |

| Deploy to server | Deployment Guide |

| Common questions | FAQ |

Core Features

- Real-time funding rate monitoring across multiple exchanges

- WebSocket market data streaming with automatic reconnection

- Atomic order execution with automatic rollback on failure

- Automatic max leverage detection with symmetric resolution for hedged positions

- Slippage protection with adaptive limit orders

- Paper trading mode for safe testing

- Encrypted credentials (AES-256-GCM)

- OpenTelemetry metrics & Grafana dashboards

- Docker containerization with compose support

- Fast graceful shutdown

Support

- GitHub Issues: https://github.com/thiras/wealth/issues

- Repository: https://github.com/thiras/wealth

License & Disclaimer

License: Proprietary License - See LICENSE file for details

⚠️ Disclaimer: Cryptocurrency trading involves substantial risk. Use at your own risk. The authors assume no responsibility for financial losses.

Trading Strategy Guide

Understanding how the Wealth bot generates profits through funding rate arbitrage

Overview

The Wealth bot implements a funding rate arbitrage strategy that profits from differences in funding rates across cryptocurrency exchanges while maintaining delta-neutral positions (no exposure to price movements).

Strategy Flow

stateDiagram-v2

[*] --> Monitoring: Start Bot

Monitoring --> Evaluating: Found Opportunity

Evaluating --> Monitoring: Below Threshold

Evaluating --> Executing: Meets Criteria

state Executing {

[*] --> PlacingLong

PlacingLong --> PlacingShort

PlacingShort --> Hedging

Hedging --> Completed

PlacingLong --> RollingBack: Failure

PlacingShort --> RollingBack: Failure

RollingBack --> RolledBack

}

Executing --> Active: Completed

Executing --> Monitoring: RolledBack

Active --> Closing: Exit Trigger

Closing --> Monitoring: Position Closed

note right of Active

Exit Triggers:

- Target profit reached

- Spread reversal

- Trailing stop

- Max duration

end note

What Are Funding Rates?

Funding rates are periodic payments exchanged between traders holding long and short positions in perpetual futures contracts. They keep the perpetual futures price aligned with the spot price.

- Positive funding rate: Longs pay shorts

- Negative funding rate: Shorts pay longs

- Payment frequency: Varies by exchange:

- Binance/Bybit: Every 8 hours (3× daily)

- HyperLiquid: Every 1 hour (24× daily)

- Aster: Every 4-8 hours depending on symbol (fetched automatically)

How the Strategy Works

The Arbitrage Opportunity

flowchart TB

subgraph Funding["Funding Rate Arbitrage"]

direction TB

A[Exchange A<br/>Low Funding Rate]

B[Exchange B<br/>High Funding Rate]

A -->|"LONG Position<br/>(Pay low funding)"| POS[Delta-Neutral<br/>Position]

B -->|"SHORT Position<br/>(Receive high funding)"| POS

POS -->|"Net Profit"| PROFIT["Spread = High Rate - Low Rate"]

end

style A fill:#c8e6c9

style B fill:#ffcdd2

style POS fill:#e3f2fd

style PROFIT fill:#fff9c4

Different exchanges often have different funding rates for the same asset. The bot exploits this by:

- Opening a LONG position on the exchange with the lower (or negative) funding rate

- Opening a SHORT position on the exchange with the higher funding rate

- Collecting the spread between the two rates every funding period

Delta-Neutral = Market-Neutral

Because you hold equal and opposite positions:

- If BTC price goes up: Your long profits, your short loses → net zero

- If BTC price goes down: Your long loses, your short profits → net zero

- Your only P&L comes from the funding rate difference

Visual Example

Exchange A (Binance): Funding Rate = +0.01% → You go LONG (receive 0.01%)

Exchange B (HyperLiquid): Funding Rate = +0.05% → You go SHORT (pay 0.05%)

Your position:

┌─────────────────────────────────────────────────────────────┐

│ LONG 0.1 BTC on Binance ←→ SHORT 0.1 BTC on HyperLiquid │

│ (Receive funding) (Pay funding) │

└─────────────────────────────────────────────────────────────┘

Net result per 8-hour period:

Receive: +0.01% on Binance

Pay: -0.05% on HyperLiquid

────────────────────────────

Wait... that's negative!

Actually, you want the OPPOSITE - go SHORT where rates are HIGH:

Pay: -0.01% on Binance (you're long, you pay positive funding)

Receive: +0.05% on HyperLiquid (you're short, you receive positive funding)

────────────────────────────

Net: +0.04% profit per 8 hours

Profit Calculation Example

Position size: $10,000 per side

Funding spread: 0.04% (4 basis points)

Leverage: 10x

Per funding period (every 8 hours):

Profit = $10,000 × 0.0004 = $4.00

Daily (3 funding periods):

Profit = $4.00 × 3 = $12.00

Monthly:

Profit = $12.00 × 30 = $360.00

Annualized APY:

APY = 0.04% × 3 × 365 = 43.8%

When Does the Bot Open Positions?

The bot continuously monitors funding rates and opens positions when:

- Spread exceeds threshold: The funding rate difference meets your configured minimum (default: 0.04%)

- Sufficient balance: You have enough collateral on both exchanges

- Position limits not reached: You haven't hit your maximum concurrent positions

- Positive expected value: After accounting for fees and slippage, the trade is profitable

When Does the Bot Close Positions?

Positions are closed automatically when:

- Target profit reached: Default 5% profit on position

- Spread reverses: The funding rate advantage disappears or reverses

- Trailing stop triggered: Profit retraces too much from peak (protects gains)

- Manual shutdown: You stop the bot gracefully

Risk Management Features

Delta-Neutral Protection

- Equal position sizes on both exchanges

- No exposure to price movements

- Profit comes only from funding rate spread

Slippage Protection

- Uses limit orders with timeout

- Falls back to market orders if needed

- Configurable maximum slippage tolerance

Trailing Stop Loss

- Activates after reaching profit threshold (default: 3%)

- Locks in minimum profit (default: 2%)

- Closes if profit retraces too much from peak

Atomic Execution

- Opens both legs simultaneously

- If one leg fails, the other is rolled back

- Prevents unhedged (risky) positions

Position Size Limits

- Maximum position size cap (USD)

- Maximum percentage of balance per trade

- Maximum concurrent positions

Configuring the Strategy

Key parameters in config.toml:

[trading]

# Minimum spread to open a position (0.04% = 4 basis points)

min_funding_spread = 0.04

# Position sizing

position_size_percent = 0.30 # Use 30% of available balance

max_position_usd = 10000 # Cap at $10,000 per position

max_concurrent_positions = 5 # Maximum open positions

# Profit targets

target_profit_percent = 0.05 # Close at 5% profit

[risk]

# Trailing stop configuration

trailing_stops_enabled = true

trailing_stop_activation = 0.03 # Activate at 3% profit

trailing_stop_distance = 0.40 # Allow 40% retracement

trailing_stop_min_lock = 0.02 # Lock in minimum 2%

# Slippage protection

max_slippage_bps = 50 # Maximum 0.5% slippage

Understanding Expected Value (EV)

Before opening a position, the bot calculates the expected value - whether the trade will be profitable after costs:

flowchart LR

subgraph EV["Expected Value Calculation"]

SPREAD[Funding Spread] --> GROSS[Gross EV]

TIME[Time Weight] --> GROSS

GROSS --> NET[Net EV]

FEES[Entry + Exit Fees] --> NET

SLIP[Slippage Estimate] --> NET

NET --> DECISION{EV > Threshold?}

DECISION -->|Yes| TRADE[Execute Trade]

DECISION -->|No| SKIP[Skip Opportunity]

end

style GROSS fill:#e8f5e9

style NET fill:#fff3e0

style TRADE fill:#c8e6c9

style SKIP fill:#ffcdd2

Expected Value = (Funding Spread × Time Weight) - (Entry Fees + Exit Fees + Slippage)

- Funding Spread: The rate difference between exchanges

- Time Weight: Reduced value if close to next funding payment

- Fees: Trading fees on both exchanges (entry and exit)

- Slippage: Expected price impact

The bot only opens positions with positive expected value.

Pair Selection Strategies

The bot supports multiple strategies for selecting which trading pairs to monitor:

Arbitrage-Based Selection (Recommended)

Sort pairs by their current funding rate spread to find the best arbitrage opportunities:

[instrument_discovery]

enabled = true

use_loris_rankings = true

loris_sort_by = "arbitrage" # Sort by funding spread (default)

How it works:

- For each symbol, finds the exchange with the lowest rate (go long) and highest rate (go short)

- Calculates the spread:

short_rate - long_rate - Ranks symbols by spread size (highest first)

- Prioritizes pairs with immediate profit potential

Best for: Active traders seeking maximum returns

Liquidity-Based Selection

Sort pairs by open interest rank to prioritize the most liquid markets:

[instrument_discovery]

enabled = true

use_loris_rankings = true

loris_sort_by = "oi_rank" # Sort by liquidity

How it works:

- Uses Binance open interest rankings as a proxy for liquidity

- Lower rank = more liquid (BTC is usually rank 1)

- Prioritizes easy entry/exit with minimal slippage

Best for: Conservative traders, larger position sizes

Volume-Based Selection

Sort pairs by 24h trading volume using direct exchange APIs:

[instrument_discovery]

enabled = true

use_loris_rankings = false # Use exchange APIs

How it works:

- Fetches 24h volume from each exchange directly

- Ranks pairs by trading activity

- No third-party data dependency

Best for: Traders who prefer direct data sources

Supported Exchanges

| Exchange | Funding Interval | Max Leverage | Notes |

|---|---|---|---|

| Binance Futures | 8 hours | 125x | Most liquid |

| Bybit Perpetuals | 4-8 hours* | 100x | UTA required |

| HyperLiquid | 1 hour | 50x | 24× daily funding |

| Aster Futures | 4-8 hours* | 125x | Per-symbol intervals |

*Bybit and Aster funding intervals vary per symbol. The bot automatically fetches per-symbol intervals via API at startup, refreshes every 4 hours, and receives real-time updates from WebSocket streams.

Note: HyperLiquid's hourly funding means more frequent profit collection but requires different EV calculations.

Frequently Asked Questions

What happens if one exchange goes down?

The bot monitors connectivity and will:

- Alert you to connection issues

- Prevent new positions from opening

- Existing positions remain open (both legs on different exchanges)

Can I lose money?

While the strategy is market-neutral, risks include:

- Fee costs: If spread narrows before covering fees

- Liquidation: If leverage is too high and price moves sharply

- Exchange risk: Counterparty risk on centralized exchanges

- Execution risk: Slippage during entry/exit

How much capital do I need?

Minimum recommended: $1,000 per exchange ($2,000 total)

With leverage, you can control larger positions:

- $1,000 at 10x = $10,000 position size

- Required margin = Position / Leverage + Safety Buffer

What's a good minimum spread to trade?

- Conservative: 0.05% (5 basis points) - fewer trades, higher quality

- Moderate: 0.04% (4 basis points) - balanced approach

- Aggressive: 0.03% (3 basis points) - more trades, lower margins

How often are there opportunities?

This varies by market conditions:

- High volatility: More funding rate divergence = more opportunities

- Low volatility: Rates converge = fewer opportunities

- Typical: 2-5 high-quality opportunities per day

See Also

- Configuration Guide - Detailed parameter reference

- Getting Started - Initial setup

- Monitoring Guide - Track your positions

- Troubleshooting - Common issues

Strategy Calculation Formulas

Mathematical reference for funding rate arbitrage calculations, position sizing, and profitability analysis

Table of Contents

- Funding Rate Arbitrage

- Expected Value (EV) Calculation

- Position Sizing

- Fee Calculations

- Profit & Loss

- Risk Metrics

- Configuration Reference

Funding Rate Arbitrage

Core Concept

Funding rate arbitrage exploits differences in funding rates across exchanges while maintaining delta-neutral positions.

Funding Rate Spread

Where:

rate_short= funding rate on high-rate exchange (short position)rate_long= funding rate on low-rate exchange (long position)

Example:

Binance BTCUSDT: +0.0001 (1 basis point)

HyperLiquid BTCUSDT: +0.0006 (6 basis points)

spread = |0.0006 - 0.0001| = 0.0005 = 5 basis points = 0.05%

Annual Percentage Yield (APY)

Where:

funding_intervals_per_yeardepends on exchange funding frequency- Spread is expressed as a decimal (e.g., 0.0005)

APY by Exchange Interval:

| Exchange | Intervals/Day | Intervals/Year | APY Multiplier |

|---|---|---|---|

| Binance/Bybit | 3 | 1,095 | spread × 1,095 |

| HyperLiquid | 24 | 8,760 | spread × 8,760 |

| Aster | 3-6 | 1,095-2,190 | varies by symbol |

Example (8-hour interval):

spread = 0.0005 (5 basis points)

APY = 0.0005 × 1,095 = 0.5475 = 54.75%

Example (1-hour interval - HyperLiquid):

spread = 0.0001 (1 basis point per hour)

APY = 0.0001 × 8,760 = 0.876 = 87.6%

Expected Value (EV) Calculation

The bot uses risk-adjusted expected value to filter opportunities and ensure trades are profitable after all costs.

Funding Intervals by Exchange

| Exchange | Interval | Minutes | Payments/Day |

|---|---|---|---|

| Binance | 8 hours | 480 | 3 |

| Bybit | 4-8 hours | 240-480 | 3-6 (per-symbol)* |

| HyperLiquid | 1 hour | 60 | 24 |

| Aster | 4-8 hours | 240-480 | 3-6 (per-symbol)* |

*Bybit and Aster funding intervals vary by symbol. The bot automatically fetches per-symbol intervals via REST API at startup (refreshed every 4h) and from WebSocket streams in real-time.

Cross-Exchange Yield Normalization

When trading across exchanges with different funding intervals (e.g., HyperLiquid + Binance), the bot normalizes yields to a common 8-hour reference period. This is important because HyperLiquid pays funding 8x more frequently than Binance/Bybit.

How It Works:

| Position | Rate | Payments in 8h | Yield |

|---|---|---|---|

| Long Binance | +0.01%/8h | 1 | -0.01% (pay) |

| Short HyperLiquid | +0.10%/1h | 8 | +0.80% (receive) |

| Total | +0.79% |

Key Benefit: A 9 bps simple spread becomes 79 bps normalized yield when HyperLiquid's 8x payment frequency is properly accounted for.

Time Weighting

Where:

min_interval= minimum of both exchange intervals (determines next funding)- Weight approaches 1 as funding time approaches

- Weight approaches 0 immediately after funding

Gross Expected Value

Transaction Costs

For limit orders (maker fees):

For market orders (taker fees + slippage):

Staleness Haircut

Default: haircut = 0.03 (3 basis points = 0.03%)

Adjusted Expected Value

Qualification Criteria

An opportunity qualifies if:

Default thresholds (percentage form):

min_ev_bps= 0.05 (5 basis points = 0.05%)min_spread_threshold= 0.04 (4 basis points = 0.04%)

Complete EV Example

Scenario:

- Binance BTCUSDT: +0.01% (long position, 8h interval)

- HyperLiquid BTCUSDT: +0.10% (short position, 1h interval)

- Time to funding: 60 minutes (HyperLiquid's next funding)

- Order type: Limit (maker fees)

Step 1: Calculate normalized spread

Long Binance: -0.01% × (480/480) = -0.01% (pay 1 payment)

Short HyperLiquid: +0.10% × (480/60) = +0.80% (receive 8 payments)

Normalized spread = -0.01% + 0.80% = +0.79% (79 bps)

Step 2: Time weighting (using minimum interval = 60 min)

Step 3: Gross EV

Step 4: Calculate costs

Binance fees: 0.02% maker (entry) + 0.02% maker (exit) = 0.04%

HyperLiquid fees: 0.0144% maker (entry) + 0.0144% maker (exit) = 0.0288%

Total costs: ~7 bps

Step 5: Staleness haircut

Data age: < 4 minutes

Staleness: 0

Step 6: Adjusted EV

Step 7: Qualification check

adjusted_ev (72 bps) >= min_ev (5 bps) ✅

raw_spread (9 bps) >= min_spread (4 bps) ✅

Result: QUALIFIES

Expected profit per $10,000 position (over 8h reference):

Note: The normalized EV (72 bps after costs) is much higher than what you'd calculate from the simple 9 bps spread because HyperLiquid pays funding 8 times per Binance cycle.

Position Sizing

Conservative Sizing Formula

The bot reserves margin for both opening AND closing positions:

Where:

balance= available balance on exchange (USDT)percentage= position size percentage (default: 0.30 = 30%)leverage= configured leverage (default: 10x)- Division by 2 reserves margin for closing

Example:

balance = $1,000 USDT

percentage = 0.30 (30%)

leverage = 10x

position_size = (1,000 × 0.30 / 2) × 10

= (300 / 2) × 10

= 150 × 10

= $1,500 USD notional

Quantity Calculation

Must be rounded to exchange precision:

Example:

position_size = $1,500

BTC price = $50,000

precision = 3 decimals (0.001 BTC minimum)

quantity = 1,500 / 50,000 = 0.030 BTC

quantity_rounded = floor(0.030 / 0.001) × 0.001 = 0.030 BTC ✅

Kelly Criterion Sizing

The bot supports two position sizing modes:

Mode 1: Kelly Criterion (Dynamic)

Enabled when use_kelly_criterion = true (default). Sizes positions based on expected value and variance:

With safety caps:

Where:

kelly_cap= 0.25 (quarter-Kelly, default)max_notional=$10,000(per-symbol cap, default)max_utilization= 0.50 (50% of balance, default)

Use when: You want dynamic sizing that increases with edge quality and decreases with variance.

Mode 2: Fixed Percentage (Simple)

Enabled when use_kelly_criterion = false. Uses fixed percentage of available capital:

With safety cap:

Use when: You want predictable, consistent position sizing regardless of opportunity quality.

Configuration:

[trading]

use_kelly_criterion = true # Toggle between Kelly and fixed modes

kelly_fraction = 0.25 # Only used in Kelly mode

max_exchange_utilization = 0.5 # Used in both modes

max_notional_per_symbol = 10000 # Hard cap for both modes

Fee Calculations

Exchange Fee Structure

| Exchange | Maker Fee | Taker Fee | Funding Interval |

|---|---|---|---|

| Binance | 0.02% | 0.04% | 8 hours |

| Bybit | 0.01% | 0.06% | 4-8 hours* |

| HyperLiquid | 0.00% | 0.035% | 1 hour** |

| Aster | 0.02% | 0.04% | 4-8 hours* |

*Bybit and Aster funding intervals vary per symbol (4h or 8h), fetched dynamically via API and WebSocket **HyperLiquid has 24 funding payments per day (hourly)

Order Fee Calculation

Example:

quantity = 0.1 BTC

price = $50,000

fee_rate = 0.0004 (0.04% taker)

notional = 0.1 × 50,000 = $5,000

fee = 5,000 × 0.0004 = $2.00

Round-Trip Cost

For entering and exiting a position:

Example (limit orders):

Binance maker: 0.02%

HyperLiquid maker: 0.00%

Entry cost: (0.0002 + 0.0000) = 0.0002 = 0.02%

Exit cost: (0.0002 + 0.0000) = 0.0002 = 0.02%

Total: 0.0004 = 0.04% = 4 basis points

On $10,000 position: $10,000 × 0.0004 = $4.00

Breakeven Spread

Minimum spread needed to be profitable:

Example (3 funding periods = 24 hours):

round_trip_cost = 0.0004 (4 bps)

holding_periods = 3

breakeven = 0.0004 / 3 = 0.000133 = 1.33 bps per period

Profit & Loss

Funding Payment Calculation

For long position:

- Positive rate: pay funding

- Negative rate: receive funding

For short position:

- Positive rate: receive funding

- Negative rate: pay funding

Arbitrage Profit Per Period

Example:

position_size = $10,000

Binance rate (long): +0.0001

HyperLiquid rate (short): +0.0006

profit = 10,000 × (0.0006 - 0.0001)

= 10,000 × 0.0005

= $5.00 per funding period

Net Profit After Fees

Example:

gross_profit = $5.00 per period × 3 periods = $15.00

entry_fees = $4.00

exit_fees = $4.00

net_profit = 15.00 - 4.00 - 4.00 = $7.00 per day

monthly = $7.00 × 30 = $210.00

Return on Capital

Example:

position_size = $10,000

leverage = 10x

margin_used = 10,000 / 10 = $1,000

daily_profit = $7.00

daily_ROC = 7.00 / 1,000 = 0.007 = 0.7%

annual_ROC = 0.007 × 365 = 2.555 = 255.5%

ROI (Return on Investment)

The ROI displayed in the TUI is calculated as:

Where:

funding_collected= total funding payments received since position openedtrading_fees= trading fees for both legs (entry + exit). Note: as of now, the fee tracker only captures entry fees; exit fees are included in the formula but are effectively $0 until exit-fee tracking is implemented.position_size= notional value of the position

ROI Display States:

| Display | Meaning |

|---|---|

1.23% | Actual ROI with confirmed fees from exchange API |

1.23%* | ROI with estimated fees (asterisk = estimation) |

... | Fees being fetched from exchange |

N/A | Legacy position without fee tracking data |

Fee Estimation Fallback:

When exchange API calls fail or timeout (2 minutes), fees are estimated:

This uses a default taker fee rate of 0.05% (5 basis points) per leg.

Example:

position_size = $1,000

funding_collected = $5.00

entry_fee_long = $0.50

entry_fee_short = $0.35

ROI = (5.00 - 0.50 - 0.35) / 1,000 × 100%

= 4.15 / 1,000 × 100%

= 0.415%

Unrealized P&L (Price Spread)

Added in v0.58: The TUI and metrics now display unrealized P&L from price spread movements, not just funding collected.

While funding rate arbitrage is theoretically delta-neutral, price divergence between exchanges creates real P&L that must be tracked. This is especially important when exchanges have different liquidity or when prices move during entry/exit.

Formula:

Where:

Example (Spread Reversal - Loss):

# Position entered with 0.1 BTC

long_entry_price = $40,000 (Binance)

short_entry_price = $40,000 (Aster)

current_price = $40,100 (price moved up)

long_leg_pnl = (40,100 - 40,000) × 0.1 = +$10.00 (profit)

short_leg_pnl = (40,000 - 40,100) × 0.1 = -$10.00 (loss)

# In theory, should net to $0 if hedged properly

# But with slippage or different prices on each exchange:

long_entry_price = $40,000 (Binance)

short_entry_price = $39,950 (Aster - worse fill)

current_price = $40,100

long_leg_pnl = (40,100 - 40,000) × 0.1 = +$10.00

short_leg_pnl = (39,950 - 40,100) × 0.1 = -$15.00

total_price_pnl = 10.00 - 15.00 = -$5.00 (loss from spread)

Total Unrealized P&L:

Important: A position can show positive funding collected but still be losing money overall if the price spread moved against you.

Risk Metrics

Maximum Position Size

Where:

config_max=$10,000(default per-symbol cap)utilization= 0.50 (50% of balance usage)margin_rate= 1 / leverage

Example:

balance = $5,000

utilization = 0.50

leverage = 10x

margin_rate = 0.1

balance_limit = (5,000 × 0.50) / 0.1 = 25,000

max_size = min(10,000, 25,000) = $10,000

Margin Requirement

The 1.2 factor provides a 20% safety buffer.

Example:

position_size = $10,000

leverage = 10x

margin = (10,000 / 10) × 1.2 = 1,000 × 1.2 = $1,200

Liquidation Distance

Example:

margin = $1,000

maintenance = $100 (10% of margin)

position_size = $10,000

liq_distance = (1,000 - 100) / 10,000 = 0.09 = 9%

Position liquidates at 9% adverse price move

Sharpe Ratio

Calculated over historical trades for strategy performance evaluation.

Maximum Drawdown

Tracks the largest peak-to-trough decline in account equity.

Configuration Reference

Default Values

| Parameter | Default | Description |

|---|---|---|

min_spread_threshold | 0.04 (4 bps) | Minimum spread to qualify |

min_ev_bps | 0.05 (5 bps) | Minimum expected value |

max_position_usd | $10,000 | Maximum position size |

position_size_percentage | 0.30 (30%) | Percentage of balance |

leverage | 10x | Default leverage |

kelly_cap | 0.25 | Quarter-Kelly |

max_exchange_utilization | 0.50 (50%) | Max balance usage |

staleness_haircut_bps | 0.03 (3 bps) | Penalty for stale data |

Exchange Fee Rates

| Exchange | Maker | Taker |

|---|---|---|

| Binance Futures (VIP 0) | 0.02% | 0.04% |

| Bybit (Standard) | 0.01% | 0.06% |

| HyperLiquid | 0.00% | 0.035% |

| Aster | 0.02% | 0.04% |

Example Configuration

[trading]

# Spread thresholds

min_funding_spread = 0.04 # 4 basis points

min_ev_bps = 0.05 # 5 basis points

# Position sizing

position_size_percent = 0.30 # 30% of balance

max_position_usd = 10000 # $10,000 cap

leverage = 10 # 10x leverage

# Kelly criterion settings

use_kelly_criterion = true

kelly_fraction = 0.25 # Quarter-Kelly

max_exchange_utilization = 0.50 # 50% max usage

[risk]

# Slippage

max_slippage_bps = 50 # 0.5% maximum

estimated_slippage = 0.001 # 0.1% estimate

Quick Reference Card

Profit Estimation

| Spread (bps) | Position Size | Per Period | Daily | Monthly |

|---|---|---|---|---|

| 4 | $10,000 | $4.00 | $12.00 | $360 |

| 5 | $10,000 | $5.00 | $15.00 | $450 |

| 10 | $10,000 | $10.00 | $30.00 | $900 |

| 20 | $10,000 | $20.00 | $60.00 | $1,800 |

APY by Spread

| Spread (bps) | APY (Pre-Fee) | APY (Post-Fee, ~4bps cost) |

|---|---|---|

| 4 | 43.8% | 0% |

| 5 | 54.75% | 10.95% |

| 10 | 109.5% | 65.7% |

| 20 | 219% | 175.2% |

Minimum Capital Requirements

| Position Target | Leverage | Margin Needed | Recommended Buffer |

|---|---|---|---|

| $5,000 | 10x | $500 | $750 |

| $10,000 | 10x | $1,000 | $1,500 |

| $20,000 | 10x | $2,000 | $3,000 |

| $50,000 | 10x | $5,000 | $7,500 |

See Also

- Trading Strategy - Strategy overview and concepts

- Configuration Guide - Detailed parameter reference

- Getting Started - Initial setup

- Monitoring Guide - Track your positions

Note: All formulas use decimal representation (e.g., 0.0005 = 5 basis points = 0.05%). The bot maintains high precision using Rust's Decimal type (96-bit precision) for all calculations.

Getting Started Guide

Quick start guide for installing and running the Wealth Trading Bot

⏱️ Estimated time: 10-15 minutes for paper trading, 20-30 minutes for live trading

Quick Start Flow

flowchart TB

subgraph Setup["🔧 Initial Setup"]

A[Download Binary] --> B[Create Config]

B --> C{Paper or Live?}

end

subgraph Paper["📄 Paper Trading"]

C -->|Paper| D[Run: wealth run]

D --> E[Monitor at :9090]

end

subgraph Live["💰 Live Trading"]

C -->|Live| F[Get API Keys]

F --> G[Create Encrypted Credentials]

G --> H[wealth credentials add]

H --> I[Set WEALTH__EXECUTION__MODE=live]

I --> J[Run: wealth run]

J --> K[Enter Passphrase]

K --> L[Monitor at :9090]

end

style Setup fill:#e3f2fd

style Paper fill:#e8f5e9

style Live fill:#fff3e0

Architecture Overview

flowchart LR

subgraph Exchanges["Supported Exchanges"]

BIN[Binance Futures]

BYB[Bybit Perpetuals]

HL[HyperLiquid]

AST[Aster Futures]

end

subgraph Bot["Wealth Bot"]

WS[WebSocket Streams]

API[REST APIs]

STRAT[Strategy Engine]

end

subgraph Outputs["Monitoring"]

METRICS[Metrics :9090]

LOGS[Structured Logs]

HEALTH[Health Endpoint]

end

BIN & BYB & HL & AST <--> WS

BIN & BYB & HL & AST <--> API

WS --> STRAT

API --> STRAT

STRAT --> METRICS

STRAT --> LOGS

STRAT --> HEALTH

Prerequisites

- Operating System: Linux, macOS, or Windows

- Exchange Accounts: Binance Futures, Bybit Perpetuals, HyperLiquid, or Aster Futures (optional for paper trading)

Installation

Option 1: Download Binary (Recommended)

Download the latest release for your platform:

# Linux (x86_64)

curl -LO https://github.com/thiras/wealth/releases/latest/download/wealth-linux-x86_64.tar.gz

tar -xzf wealth-linux-x86_64.tar.gz

chmod +x wealth

sudo mv wealth /usr/local/bin/

# macOS (Apple Silicon)

curl -LO https://github.com/thiras/wealth/releases/latest/download/wealth-darwin-arm64.tar.gz

tar -xzf wealth-darwin-arm64.tar.gz

chmod +x wealth

sudo mv wealth /usr/local/bin/

# macOS (Intel)

curl -LO https://github.com/thiras/wealth/releases/latest/download/wealth-darwin-x86_64.tar.gz

tar -xzf wealth-darwin-x86_64.tar.gz

chmod +x wealth

sudo mv wealth /usr/local/bin/

Verify installation:

wealth --version

Option 2: Docker (Recommended for Production)

# Pull the latest image

docker pull ghcr.io/thiras/wealth:latest

# Run with Docker Compose (recommended)

curl -LO https://raw.githubusercontent.com/thiras/wealth/main/compose.yml

docker compose up -d

# Or run directly

docker run -d --name wealth \

-v $(pwd)/config.toml:/app/config.toml \

-v $(pwd)/credentials.encrypted.json:/app/credentials.encrypted.json \

-e CREDENTIALS_PASSPHRASE="your_passphrase" \

ghcr.io/thiras/wealth:latest

Option 3: Build from Source

Building from source requires Rust toolchain and development dependencies.

First Run (Paper Trading)

The bot runs in paper trading mode by default, which is safe for testing without real money.

# Run with defaults (paper trading)

wealth run

# Show help and available commands

wealth --help

You should see output like:

INFO Initializing bot | mode=paper_trading

INFO Starting WebSocket price streams

INFO Binance WebSocket connected

INFO Bybit WebSocket connected

INFO Bot running | metrics_port=9090

Check Health

In another terminal:

# Health endpoint

curl http://localhost:9090/health | jq

# Metrics endpoint (JSON info about OTLP config)

curl http://localhost:9090/metrics | jq

# Query actual metrics in Grafana/Prometheus backend

Configuration

Paper Trading (Default)

No credentials needed! Just run:

wealth run

Live Trading Setup

The bot supports two methods for providing credentials, and automatically chooses the right one:

-

Encrypted Credentials (Recommended for production)

- Set

CREDENTIALS_PASSPHRASEin.env - Use

wealth credentialscommands to manage - Credentials stored in AES-256-GCM encrypted file

- Set

-

Environment Variables (For development/testing)

- Set exchange-specific variables in

.env - Simpler but less secure

- Bot automatically falls back to this if no encrypted file

- Set exchange-specific variables in

No configuration needed - just set up one method and the bot handles the rest!

Step 1: Get API Keys

- Binance API Keys - API Key + Secret Key

- Enable Futures trading permission

- IP whitelist recommended for production

- Bybit API Keys - API Key + Secret Key

- Requires Unified Trading Account (UTA)

- Enable Contract trading permission

- Aster API Keys - API Key + Secret Key (Binance-compatible format)

- Variable funding intervals: Aster uses 4h or 8h funding intervals per symbol (fetched automatically by the bot)

- API compatibility: Uses Binance-compatible endpoints, so credential setup is identical

- HyperLiquid: Use your Ethereum wallet private key (0x... format)

- Direct mode: Just the private key

- Subkey mode (recommended): Master wallet address + API wallet private key

- Vault mode: Vault address + API wallet private key

Step 2: Create Encrypted Credentials

# Create encrypted config and add credentials (interactive mode)

export CREDENTIALS_PASSPHRASE="your_secure_passphrase"

wealth credentials create

wealth credentials add binance

wealth credentials add bybit

wealth credentials add hyperliquid

# Verify setup

wealth credentials verify

📖 For detailed credential setup including HyperLiquid wallet modes (direct, subkey, vault), see Security Guide - Credential Setup.

Step 3: Run in Live Mode

export WEALTH__EXECUTION__MODE=live

wealth run

# You'll be prompted: 🔐 Enter credentials passphrase:

Note: The bot will automatically prompt for your passphrase if CREDENTIALS_PASSPHRASE is not set. For automation or scripts, set the env var to skip the prompt:

export CREDENTIALS_PASSPHRASE="your_secure_passphrase"

wealth run # No prompt

Basic Commands

# Initialize configuration file

wealth init

# Run the bot

wealth run

# Verify configuration

wealth verify

# Display current config

wealth config

# Manage credentials

wealth credentials create

wealth credentials add binance # Interactive mode

wealth credentials verify

# Generate shell completions

wealth completions bash > ~/.local/share/bash-completion/completions/wealth

💡 Tip: Once running, you can edit config.toml and changes will apply automatically within 500ms without restart. See Configuration Hot-Reload for details.

Testing the Setup

1. Verify Configuration

wealth verify --encrypted

2. Check Exchange Connectivity

wealth health --all

3. View Current Config

wealth config

4. Monitor Metrics

# In your browser

open http://localhost:9090/metrics

Common First-Run Issues

Issue: "Failed to decrypt credentials"

Solution: Enter the correct passphrase when prompted, or set the environment variable:

# Option 1: Just run and enter passphrase when prompted

wealth run

# 🔐 Enter credentials passphrase: ********

# Option 2: Set environment variable

export CREDENTIALS_PASSPHRASE="your_passphrase"

wealth run

Issue: "Configuration validation failed"

Solution: Check your configuration values

wealth verify

Issue: WebSocket connection failed

Solution: Check internet connection and firewall settings. Ensure your network allows outbound connections to:

- Binance:

stream.binance.com:443 - Bybit:

stream.bybit.com:443 - HyperLiquid:

api.hyperliquid.xyz:443

Issue: "Exchange rate limit exceeded"

Solution: The bot has built-in rate limiting, but if you see this:

- Wait 1-2 minutes before retrying

- Check if you have other tools using the same API keys

- Consider using different API keys for different tools

Issue: "Insufficient balance" in paper trading

Solution: Paper trading simulates with virtual balances. If you see balance issues:

- Check your

config.tomlfor position sizing settings - Ensure

max_position_usdis reasonable for simulated balance

📖 More issues? See Troubleshooting Guide for comprehensive problem-solving.

Next Steps

Once your bot is running:

- Monitor Performance: Visit

http://localhost:9090/metrics - View Logs: Check terminal output for trading activity

- Configure Strategy: See Configuration Guide

- Set Up Dashboards: See Monitoring Guide

- Deploy to Production: See Deployment Guide

Quick Reference

Paper Trading (Safe):

wealth run # That's it!

Live Trading (Requires credentials):

export WEALTH__EXECUTION__MODE=live

wealth run

# Enter passphrase when prompted, or set CREDENTIALS_PASSPHRASE env var

Custom Configuration:

# Use environment variables or config.toml for customization

export WEALTH__OBSERVABILITY__METRICS_PORT=8080

wealth run --verbose

AI-Powered Monitoring (After setup):

# Ask AI natural language questions like:

# "What's my current P&L?"

# "Show funding rates for BTCUSDT"

# "Are there any firing alerts?"

Stop the Bot:

Press Ctrl+C for graceful shutdown (takes ~6-8 seconds to close all positions safely)

Note: Shutdown is fast thanks to shutdown-aware background tasks that respond instantly to signals.

Related Documentation

| Topic | Guide |

|---|---|

| Command reference | CLI Reference |

| All config options | Configuration Guide |

| Secure credentials | Security Guide |

| Cloud monitoring | Grafana Cloud Setup |

| Production deploy | Deployment Guide |

| Common issues | Troubleshooting |

Practical Examples & Common Workflows

This guide provides practical, real-world examples for using the Wealth trading bot. All examples assume you've completed the Getting Started guide.

Table of Contents

- Quick Start Example

- Opening Your First Position

- Monitoring Active Positions

- Closing Positions

- Alert Integration

- Troubleshooting Common Issues

Quick Start Example

Complete Workflow from Scratch

This example shows the complete workflow from installation to your first trade:

# 1. Download and install (or use Docker)

# See Getting Started guide for installation options

# 2. Set up credentials

export CREDENTIALS_PASSPHRASE="your-secure-passphrase-here"

wealth credentials create

wealth credentials add binance # Interactive prompts

wealth credentials add hyperliquid

# 3. Verify setup

wealth verify

# 4. Run the bot (paper trading by default)

wealth run

📖 For detailed setup instructions, see:

Expected Output:

2025-11-07T10:30:00Z INFO Wealth Trading Bot

2025-11-07T10:30:00Z INFO Mode: PAPER TRADING (no real orders)

2025-11-07T10:30:01Z INFO Initialized leverage: BTCUSDT = 15x

2025-11-07T10:30:02Z INFO WebSocket connected: Binance ticker stream

2025-11-07T10:30:03Z INFO WebSocket connected: HyperLiquid ticker stream

2025-11-07T10:30:04Z INFO Fetching funding rates...

2025-11-07T10:30:05Z INFO Binance BTCUSDT: 0.0100%

2025-11-07T10:30:05Z INFO HyperLiquid BTC: 0.0500%

2025-11-07T10:30:05Z INFO Spread detected: 0.0400% (above 0.0300% threshold)

2025-11-07T10:30:05Z INFO Opening arbitrage position...

Opening Your First Position

Manual Position Opening (Development/Testing)

# Check current funding rates

wealth funding

# Output:

# Exchange Symbol Rate Next Payment

# binance BTCUSDT 0.0100% 2025-11-07 12:00:00 UTC

# hyperliquid BTC 0.0500% 2025-11-07 11:00:00 UTC

# Spread: 0.0400% ✓ (above 0.0300% threshold)

# Check available balance

wealth balance

# Output:

# Exchange Asset Free Total Reserved

# binance USDT 10000.00 10000.00 0.00

# hyperliquid USDT 10000.00 10000.00 0.00

# Start the bot (it will auto-open positions when spreads are found)

wealth run

Understanding Position Logic

The bot opens positions automatically when:

- Spread Check:

funding_rate_high - funding_rate_low >= 0.0300%(configurable) - Balance Validation: Sufficient collateral with 20% safety buffer

- Leverage Validation: Within exchange limits (1-125x Binance/Aster, 1-100x Bybit, 1-50x HyperLiquid)

- Position Limits: Under max concurrent pairs (default: 3)

Example Calculation:

Given:

- Position size: $1,000

- Leverage: 10x

- Safety buffer: 20%

Required collateral = ($1,000 / 10) * 1.2 = $120 per exchange

Total required = $120 + $120 = $240

If available balance >= $240, position opens

Monitoring Active Positions

Check Current Positions

# View all open positions

wealth positions

# Output:

# ID Symbol Long Exchange Short Exchange Size Entry Spread Current Spread Funding Collected P&L Age

# 1 BTCUSDT binance hyperliquid 0.1 BTC 0.0400% 0.0350% $2.40 $12.50 2h 15m

# 2 ETHUSDT bybit binance 2.0 ETH 0.0380% 0.0420% $1.80 $8.30 1h 45m

Real-Time Monitoring with OpenTelemetry

The bot exports metrics via OTLP to your observability backend. Check configuration:

# View OTLP configuration (JSON response)

curl -s localhost:9090/metrics | jq

# Output:

# {

# "status": "operational",

# "backend": "OpenTelemetry OTLP",

# "endpoint": "http://localhost:4317",

# "protocol": "gRPC"

# }

# Query actual metrics in Grafana or your OTLP-compatible backend:

# wealth_funding_rate{exchange="binance",symbol="BTCUSDT"}

# wealth_positions_active

# wealth_profit_loss_usd

Using Grafana (Optional)

# Start Grafana with docker-compose

docker-compose up -d grafana

# Access dashboard at http://localhost:3000

# Default credentials: admin/admin

# Pre-configured dashboard shows:

# - Active positions

# - Funding rate spreads

# - P&L over time

# - WebSocket health

# - API latency

Closing Positions

Automatic Closing (Normal Operation)

Positions close automatically when any condition is met:

- Target Profit Reached: 5% profit (configurable via

target_profit) - Spread Reversal: Spread drops below 50% of entry spread

- Emergency: Critical errors or shutdown signal

Example Auto-Close:

2025-11-07T14:30:00Z INFO Position #1 BTCUSDT reached target profit (5.2%)

2025-11-07T14:30:01Z INFO Closing position atomically...

2025-11-07T14:30:02Z INFO Close order placed: Binance (sell 0.1 BTC)

2025-11-07T14:30:03Z INFO Close order placed: HyperLiquid (buy 0.1 BTC)

2025-11-07T14:30:04Z INFO Position closed successfully. Final P&L: $52.40

Manual Emergency Close

# Close positions on specific exchange

wealth close --exchange binance --confirm

# Close positions for specific symbol

wealth close --symbol BTCUSDT --confirm

# Emergency close ALL positions (requires confirmation)

wealth close --all --confirm

# Graceful shutdown (closes all non-held positions cleanly)

# Press Ctrl+C once and wait (~6-8 seconds typical)

# Note: Held positions (marked with 🔒 in TUI) are preserved

^C

2025-11-07T14:35:00Z INFO Shutdown signal received

2025-11-07T14:35:01Z INFO Closing all positions gracefully...

2025-11-07T14:35:01Z INFO Skipping held position ETHUSDT (will persist)

2025-11-07T14:35:05Z INFO All non-held positions closed. Exiting.

Note: All close commands require --confirm flag for safety.

Verifying Position Closure

# Check positions after close

wealth positions

# Output should be empty:

# 📊 Current Positions

#

# No active positions

# Check balances are back to normal

wealth balance

Alert Integration

Discord Notifications

Set up Discord alerts for important events:

# Set your Discord webhook URL

export DISCORD_WEBHOOK_URL="https://discord.com/api/webhooks/..."

# The bot will send notifications for:

# - Position opened/closed

# - Target profit reached

# - Errors or warnings

Slack Notifications

# Set your Slack webhook URL

export SLACK_WEBHOOK_URL="https://hooks.slack.com/services/..."

Dynamic Pair Discovery Examples

Using Loris.tools Arbitrage Mode (Recommended)

The bot can automatically discover trading pairs using Loris.tools API, sorted by arbitrage opportunity:

# config.toml - Maximum arbitrage opportunities

[instrument_discovery]

enabled = true

use_loris_rankings = true # Use Loris.tools API

loris_sort_by = "arbitrage" # Sort by funding spread (default)

min_24h_volume_usd = 1_000_000 # $1M minimum liquidity

quote_asset = "USDT"

max_symbols = 20

min_exchanges = 2

exclude = ["BULL", "BEAR", "UP", "DOWN"]

refresh_interval_hours = 6 # Refresh pairs every 6 hours

# Run with discovery enabled

wealth run --enable-discovery

# Output shows arbitrage-sorted pairs:

# INFO Pair discovery using Loris rankings (sort: arbitrage)

# INFO Top arbitrage opportunities:

# 1. DOGE: spread=0.12% (Binance: -0.05%, Bybit: 0.07%)

# 2. SOL: spread=0.08% (Binance: 0.01%, HyperLiquid: 0.09%)

# 3. BTC: spread=0.04% (Binance: 0.01%, Bybit: 0.05%)

Using Loris.tools OI Rank Mode (Liquidity-Focused)

For conservative strategies prioritizing liquidity:

# config.toml - Most liquid pairs

[instrument_discovery]

enabled = true

use_loris_rankings = true

loris_sort_by = "oi_rank" # Sort by open interest (liquidity)

min_24h_volume_usd = 1_000_000

quote_asset = "USDT"

max_symbols = 10 # Fewer, more liquid pairs

min_exchanges = 2

exclude = ["BULL", "BEAR", "UP", "DOWN"]

refresh_interval_hours = 6 # Refresh pairs every 6 hours

# Output shows OI-sorted pairs:

# INFO Pair discovery using Loris rankings (sort: oi_rank)

# INFO Top pairs by liquidity:

# 1. BTC: OI rank=1

# 2. ETH: OI rank=2

# 3. SOL: OI rank=5

Using Exchange Volume Data (Direct)

For maximum control without third-party APIs:

# config.toml - Direct exchange data

[instrument_discovery]

enabled = true

use_loris_rankings = false # Use exchange APIs directly

min_24h_volume_usd = 5_000_000 # Higher threshold

quote_asset = "USDT"

max_symbols = 20

min_exchanges = 2

exchanges = ["binance_futures", "bybit_perpetuals_usd"]

refresh_interval_hours = 0 # No periodic refresh (runs at startup only)

Troubleshooting Common Issues

Issue: "Insufficient balance" error

Solution:

# Check current balance

wealth balance

# If balance is low, deposit more funds or reduce position size

# Edit config.toml:

[trading]

position_size_percentage = 0.1 # Reduce from 30% to 10%

max_position_usd = 5000.0 # Reduce cap

Issue: Position not opening despite good spread

Possible causes:

-

Balance too low

# Check required collateral # For $1000 position at 10x leverage with 20% buffer: # Required = ($1000 / 10) * 1.2 = $120 per exchange -

Leverage not initialized

# Check logs for: grep "Initialized leverage" logs/wealth.log # If missing, verify config.toml has leverage section -

Max concurrent positions reached

# Check current count wealth positions | wc -l # Increase in config if needed: "max_concurrent_pairs": 5

Issue: WebSocket keeps disconnecting

Automatic Recovery (v0.54.0+):

The bot now includes automatic per-exchange health monitoring and restart:

- Health checks every 30 seconds using ping/pong heartbeats

- Only unhealthy exchanges are restarted (not all)

- 90-second threshold before considering a stream unhealthy

- 60-second grace period for newly restarted streams

Manual troubleshooting:

# Check network connectivity

curl -I https://fstream.binance.com

curl -I https://stream.bybit.com

# Enable detailed logging to see health check status

export RUST_LOG=wealth::market_data=debug

wealth run

# Look for these log patterns:

# "All WebSocket streams healthy" - system is working

# "Exchange binance unhealthy: No activity for 95s" - single exchange restart

# "Restarting single exchange stream" - per-exchange recovery in progress

Persistent disconnection issues:

- Network instability: Check your connection quality

- Exchange rate limiting: The bot uses exponential backoff; wait for recovery

- Firewall/proxy: Ensure WebSocket connections (wss://) are allowed

Issue: Orders rejected by exchange

Common reasons:

-

Quantity too small

# Binance minimum: 0.001 BTC # HyperLiquid minimum: 0.01 BTC (varies by symbol) # Increase position size or use different symbol -

Insufficient margin

# Check exchange-specific requirements: wealth verify --check-margin -

Position mode not set (Binance)

# Bot auto-initializes hedge mode, but if it fails: # Manually set in Binance UI: Futures > Preferences > Position Mode > Hedge Mode

Related Documentation

- Getting Started - Initial setup

- Configuration Guide - Detailed config options

- CLI Reference - All commands

- API Reference - Programmatic usage

- Troubleshooting - Detailed problem solving

Next Steps

- Test in Paper Trading Mode: Run with

WEALTH__EXECUTION__MODE=paperfor 1-2 weeks - Monitor Metrics: Set up Grafana dashboard for visualization

- Set Up Alerts: Configure Discord/Slack notifications for important events

- Gradual Scaling: Start with small position sizes, increase gradually

- Review Performance: Use

wealth statsto analyze historical performance

Questions? See Troubleshooting or check the logs in logs/wealth.log.

Configuration Guide

Complete reference for configuration settings

Overview

The bot uses a unified configuration system with support for TOML configuration files and environment variables. All variables have sensible defaults and are validated on startup.

Configuration Loading Flow

flowchart TD

subgraph Priority["Configuration Loading Priority"]

direction TB

ENV["🔴 Environment Variables<br/>WEALTH__SECTION__FIELD<br/>(Highest Priority)"]

TOML["🟡 TOML/JSON Config File<br/>config.toml or config.json"]

DEF["🟢 Default Values<br/>(Fallback)"]

end

ENV --> TOML --> DEF

style ENV fill:#ffcdd2

style TOML fill:#fff9c4

style DEF fill:#c8e6c9

Configuration Structure

flowchart LR

subgraph Config["AppConfig Structure"]

direction TB

APP[AppConfig]

APP --> INST[instruments]

APP --> DISC[instrument_discovery]

APP --> LEV[leverage]

APP --> TRADE[trading]

APP --> RISK[risk]

APP --> EXEC[execution]

APP --> OBS[observability]

APP --> LIC[licensing]

end

style APP fill:#e3f2fd

style TRADE fill:#fff3e0

style RISK fill:#ffcdd2

Current Version: The bot uses a simplified configuration structure with direct field access.

Configuration Files:

config.toml- Main configuration file (instruments, leverage, trading params) - Preferredconfig.json- Legacy JSON format (still supported for backward compatibility).env- Local environment configuration for sensitive values

Hot-Reload Support: The bot supports runtime configuration updates for safe parameters without requiring a restart. See Configuration Hot-Reload for details on which parameters can be hot-reloaded.

Configuration Architecture:

AppConfig- Single unified configuration structure- Direct field access:

config.trading.*,config.risk.*,config.leverage.* - Environment variables with

WEALTH__prefix override TOML/JSON settings

Loading Priority:

- Environment variables with

WEALTH__prefix (highest priority) - TOML/JSON configuration file (

config.tomlorconfig.json) - Default values (fallback)

Configuration Sections

The configuration is organized into clear sections:

| Section | Description |

|---|---|

instruments | Trading pairs to monitor |

instrument_discovery | Dynamic pair discovery settings |

leverage | Per-symbol leverage settings |

trading | Strategy parameters (spread thresholds, position sizing) |

risk | Risk management (slippage, trailing stops, fees) |

pair_health | Pair health monitoring and auto-disable thresholds |

execution | Execution mode (paper/live), resilience, and reconciliation |

observability | Metrics, logging, telemetry |

licensing | License configuration |

Environment Variable Overrides:

- All configuration can be overridden via environment variables

- Prefix pattern:

WEALTH__SECTION__FIELD(e.g.,WEALTH__TRADING__MIN_FUNDING_SPREAD)

Trading Configuration

WEALTH__TRADING__MIN_FUNDING_SPREAD

Minimum funding rate spread required to open a position.

- Type: Decimal (0.0-1.0)

- Default:

0.04(0.04% = 4 bps) - TOML Path:

trading.min_funding_spread - Example:

WEALTH__TRADING__MIN_FUNDING_SPREAD=0.05

WEALTH__TRADING__MAX_POSITION_USD

Maximum position size cap in USD (safety limit).

- Type: Decimal

- Default:

10000($10,000) - TOML Path:

trading.max_position_usd - Example:

WEALTH__TRADING__MAX_POSITION_USD=20000

WEALTH__TRADING__POSITION_SIZE_PERCENT

Percentage of available balance to use per position.

- Type: Decimal (0.0 - 1.0)

- Default:

0.3(30%) - TOML Path:

trading.position_size_percent - Example:

WEALTH__TRADING__POSITION_SIZE_PERCENT=0.25

WEALTH__TRADING__TARGET_PROFIT_PERCENT

Target profit percentage per position.

- Type: Decimal (0.0 - 1.0)

- Default:

0.05(5%) - TOML Path:

trading.target_profit_percent - Example:

WEALTH__TRADING__TARGET_PROFIT_PERCENT=0.08

WEALTH__TRADING__MAX_POSITION_DURATION_HOURS

Maximum position duration in hours before forced exit. Prevents capital from being tied up indefinitely.

- Type: Integer

- Default:

168(7 days) - TOML Path:

trading.max_position_duration_hours - Example:

WEALTH__TRADING__MAX_POSITION_DURATION_HOURS=336 - Note: Set to

0to disable duration-based exits

WEALTH__TRADING__NARROW_SPREAD_EXIT_PERIODS

Number of consecutive narrow spread periods (8-hour intervals) before closing position.

- Type: Integer

- Default:

3(24 hours of narrow spread) - TOML Path:

trading.narrow_spread_exit_periods - Example:

WEALTH__TRADING__NARROW_SPREAD_EXIT_PERIODS=2 - Note: Set to

0for immediate spread narrowing exit

WEALTH__TRADING__MAX_CONCURRENT_POSITIONS

Maximum number of concurrent arbitrage pairs.

- Type: Integer

- Default:

5 - TOML Path:

trading.max_concurrent_positions - Example:

WEALTH__TRADING__MAX_CONCURRENT_POSITIONS=3

WEALTH__TRADING__UPDATE_INTERVAL_SECS

Funding rate update interval in seconds.

- Type: Integer

- Default:

60 - TOML Path:

trading.update_interval_secs - Example:

WEALTH__TRADING__UPDATE_INTERVAL_SECS=30

WEALTH__TRADING__MAX_HEDGE_ATTEMPTS

Maximum number of hedging attempts for partial fills.

- Type: Integer

- Default:

5 - TOML Path:

trading.max_hedge_attempts - Example:

WEALTH__TRADING__MAX_HEDGE_ATTEMPTS=3 - Purpose: Prevents infinite hedging loops when orders partially fill

WEALTH__TRADING__HEDGE_TOLERANCE_PERCENT

Hedging tolerance as percentage (when to stop hedging).

- Type: Decimal (0.0-1.0)

- Default:

0.001(0.1%) - TOML Path:

trading.hedge_tolerance_percent - Example:

WEALTH__TRADING__HEDGE_TOLERANCE_PERCENT=0.0005 - Purpose: Allows small quantity mismatches without additional hedging orders

WEALTH__TRADING__FALLBACK_PRICE_USD

Fallback price in USD used when real-time price data is unavailable.

- Type: Decimal

- Default:

100000($100,000) - TOML Path:

trading.fallback_price_usd - Example:

WEALTH__TRADING__FALLBACK_PRICE_USD=95000 - Purpose: Last-resort value for position sizing calculations when WebSocket price feeds fail

- Note: Set to approximately current BTC price for reasonable position sizing. An error is logged when fallback is used.

WEALTH__TRADING__SYMBOL_FALLBACK_PRICES

Per-symbol fallback prices when real-time data is unavailable.

- Type: Map<String, Decimal>

- Default: Empty (uses global

fallback_price_usd) - TOML Path:

trading.symbol_fallback_prices - Purpose: Provides accurate fallback prices for non-BTC symbols, improving position sizing accuracy

Example TOML Configuration:

[trading.symbol_fallback_prices]

BTCUSDT = 100000

ETHUSDT = 3500

SOLUSDT = 200

XRPUSDT = 2.5

Note: Symbol-specific fallback prices take precedence over the global fallback_price_usd. Only configure symbols you actively trade.

Note: Leverage is configured per-symbol in the [leverage] section, not as a global trading parameter.

Expected Value (EV) Gating

The bot uses expected value analysis to filter opportunities before execution. Only opportunities with positive risk-adjusted EV after costs are considered.

WEALTH__TRADING__MIN_EXPECTED_VALUE

Minimum expected value threshold (net profit after costs).

- Type: Decimal (0.0-1.0)

- Default:

0.05(0.05% = 5 bps) - TOML Path:

trading.min_expected_value - Example:

WEALTH__TRADING__MIN_EXPECTED_VALUE=0.08 - Purpose: Filters out low-quality opportunities with insufficient edge

- Formula:

EV = (time_weighted_spread × 3 funding payments) - (entry_fees + exit_fees + slippage) - Note: Time weighting applies linear decay based on minutes until next funding payment

WEALTH__TRADING__STALENESS_PENALTY

Discount applied to EV calculation when data age exceeds staleness haircut threshold.

- Type: Decimal (0.0-1.0)

- Default:

0.03(0.03% = 3 bps) - TOML Path:

trading.staleness_penalty - Example:

WEALTH__TRADING__STALENESS_PENALTY=0.05 - Purpose: Conservative adjustment for potential data lag

- When Applied: Reduces gross EV when funding rate data age exceeds

staleness_haircut_threshold_secs(default: 120s)

WEALTH__TRADING__STALENESS_HAIRCUT_THRESHOLD_SECS

Data age threshold (in seconds) for applying staleness penalty.

- Type: Integer (seconds)

- Default:

120(2 minutes) - TOML Path:

trading.staleness_haircut_threshold_secs - Example:

WEALTH__TRADING__STALENESS_HAIRCUT_THRESHOLD_SECS=180 - Purpose: Defines when funding rate data is considered "semi-stale" and warrants a penalty

- Note: Distinct from data rejection threshold - data older than 5 minutes is rejected entirely

Example EV Calculation:

Funding spread: 90 bps (0.0090)

Time to funding: 240 minutes (50% of 8h period)

Time weight: 0.5

Gross EV: 90 bps × 0.5 = 45 bps

Entry fees (both sides): 4 bps

Exit fees (both sides): 4 bps

Estimated slippage: 10 bps

Total costs: 18 bps

Adjusted EV: 45 - 18 = 27 bps

Passes threshold: 27 bps > 5 bps ✅

Kelly Position Sizing

The bot supports two position sizing modes: Kelly Criterion (dynamic, risk-adjusted) or Fixed Percentage (simple, predictable).

WEALTH__TRADING__USE_KELLY_CRITERION

Enable or disable Kelly Criterion for position sizing.

- Type: Boolean

- Default:

true - TOML Path:

trading.use_kelly_criterion - Example:

WEALTH__TRADING__USE_KELLY_CRITERION=false - When

true: Uses Kelly Criterion formula for dynamic sizing based on EV and variance - When

false: Uses fixed percentage sizing:size = min(balance) × max_exchange_utilization × leverage - Recommendation:

truefor optimal capital allocation,falsefor simpler, predictable sizing

WEALTH__TRADING__KELLY_FRACTION

Fraction of full Kelly size to use (0.0 - 1.0).

- Type: Decimal

- Default:

0.25(quarter-Kelly for conservative sizing) - TOML Path:

trading.kelly_fraction - Example:

WEALTH__TRADING__KELLY_FRACTION=0.5 - Purpose: Reduces risk by using only a fraction of the mathematically optimal Kelly size

- Recommendation: Keep at 0.25 or lower for funding rate arbitrage

WEALTH__TRADING__MAX_NOTIONAL_PER_SYMBOL

Maximum notional value per symbol across all exchanges in USD.

- Type: Decimal

- Default:

10000($10,000) - TOML Path:

trading.max_notional_per_symbol - Example:

WEALTH__TRADING__MAX_NOTIONAL_PER_SYMBOL=20000 - Purpose: Hard cap on position size regardless of Kelly calculation

- Applied: Per symbol across all exchanges (e.g., total BTC exposure)

WEALTH__TRADING__MAX_EXCHANGE_UTILIZATION

Maximum percentage of free balance to use for a single position (0.0 - 1.0).

- Type: Decimal

- Default:

0.5(50%) - TOML Path:

trading.max_exchange_utilization - Example:

WEALTH__TRADING__MAX_EXCHANGE_UTILIZATION=0.3 - Purpose: Prevents over-concentration on one exchange

- Reference Capital: Uses

min(long_exchange_balance, short_exchange_balance)for sizing

Example Kelly Sizing:

EV: 30 bps per 8h (0.003)

Variance: 0.0001 (estimated spread volatility)

Kelly fraction: EV / variance = 0.003 / 0.0001 = 30

Reference capital: min($50,000, $80,000) = $50,000

Leverage: 10x

Full Kelly size: $50,000 × 30 × 10 = $15,000,000 (unrealistic)

Apply kelly_cap (0.25): $15,000,000 × 0.25 = $3,750,000

Apply max_notional cap: min($3,750,000, $10,000) = $10,000

Apply utilization cap: min($10,000, $50,000 × 0.5) = $10,000

Final position size: $10,000 (binding constraint: notional cap)

Leverage Configuration

Leverage multiplies your position size relative to margin. Higher leverage means higher potential returns AND higher risk of liquidation.

WEALTH__LEVERAGE__DEFAULT

Default leverage for all symbols.

- Type: Integer OR

"max" - Default:

3 - TOML Path:

leverage.default - Example:

WEALTH__LEVERAGE__DEFAULT=10orWEALTH__LEVERAGE__DEFAULT=max

Supported Values:

- Numbers: Fixed leverage (e.g.,

3,5,10,20) "max": Automatically use the maximum leverage allowed by each exchange

Per-Symbol Overrides

You can configure different leverage for specific symbols using the [leverage.overrides] section:

[leverage]

default = 10 # Default 10x for most symbols

[leverage.overrides]

BTCUSDT = 5 # Lower leverage for BTC (less volatile)

ETHUSDT = 8 # Medium leverage for ETH

SOLUSDT = "max" # Use max allowed for SOL

Symmetric Leverage for Hedged Positions

When trading hedged positions across exchanges, the bot automatically ensures consistent leverage:

- If config is a fixed number: Uses that value (clamped to exchange max if needed)

- If config is

"max": Usesmin(max_exchange_A, max_exchange_B)

Example:

- Config:

SOLUSDT = "max" - Binance max for SOL: 75x

- HyperLiquid max for SOL: 50x

- Result: Bot uses 50x on both exchanges

This ensures the hedge ratio remains balanced regardless of differing exchange limits.

Max Leverage Caching

When using "max" leverage:

- Max leverage is fetched from exchange APIs on startup

- Results are cached to avoid API rate limits

- Cache is refreshed when bot restarts

Exchange API Sources:

- Binance:

/fapi/v1/leverageBracket(uses first tier max) - Bybit:

/v5/market/instruments-info(leverageFilter.maxLeverage) - HyperLiquid:

/infometa endpoint (universe[].maxLeverage) - Aster: Binance-compatible API

Recommended Settings

| Risk Profile | Default | High-Volume (BTC/ETH) | Mid-Cap (SOL/XRP) |

|---|---|---|---|

| Conservative | 3 | 3 | 2 |

| Moderate | 10 | 5-8 | 10 |

| Aggressive | "max" | 20 | "max" |

Note: Higher leverage increases both potential gains and liquidation risk. The bot does NOT automatically manage position size based on leverage—that's controlled by position_size_percent and max_position_usd.

Slippage Protection Configuration

WEALTH__RISK__MAX_SLIPPAGE_BPS

Maximum allowed slippage in basis points.

- Type: Integer

- Default:

50(0.5%) - TOML Path:

risk.max_slippage_bps - Example:

WEALTH__RISK__MAX_SLIPPAGE_BPS=30

WEALTH__RISK__MIN_SLIPPAGE_BPS

Minimum slippage buffer in basis points (always applied).

- Type: Integer

- Default:

10(0.1%) - TOML Path:

risk.min_slippage_bps - Example:

WEALTH__RISK__MIN_SLIPPAGE_BPS=5

WEALTH__RISK__MARKET_ORDER_FALLBACK_ENABLED

Whether to fall back to MARKET orders if LIMIT order doesn't fill.

- Type: Boolean

- Default:

true - TOML Path:

risk.market_order_fallback_enabled - Values:

true|false - Example:

WEALTH__RISK__MARKET_ORDER_FALLBACK_ENABLED=false

WEALTH__RISK__LIMIT_ORDER_TIMEOUT_SECS

Timeout before falling back to MARKET order (seconds).

- Type: Integer

- Default:

5 - TOML Path:

risk.limit_order_timeout_secs - Example:

WEALTH__RISK__LIMIT_ORDER_TIMEOUT_SECS=10

WEALTH__RISK__SLIPPAGE_VOLATILITY_MULTIPLIER

Multiplier to increase slippage tolerance in volatile markets.

- Type: Float

- Default:

1.5(50% wider) - TOML Path:

risk.slippage_volatility_multiplier - Example:

WEALTH__RISK__SLIPPAGE_VOLATILITY_MULTIPLIER=2.0

Post-Only (Maker) Order Configuration

Post-only orders ensure you always pay maker fees instead of taker fees, significantly reducing execution costs.

WEALTH__RISK__USE_POST_ONLY

Enable post-only (maker) order execution.

- Type: Boolean

- Default:

false - TOML Path:

risk.use_post_only - Values:

true|false - Example:

WEALTH__RISK__USE_POST_ONLY=true

Exchange-Specific Order Types:

| Exchange | Post-Only Type | API Parameter |

|---|---|---|

| Binance Futures | GTX (Good-Til-Crossing) | timeInForce=GTX |

| Bybit Perpetuals | PostOnly | timeInForce=PostOnly |

| HyperLiquid | Alo (Add Liquidity Only) | tif=Alo |

| Aster Futures | GTX | timeInForce=GTX |

WEALTH__RISK__LIMIT_PRICE_OFFSET_BPS

Price offset from market for post-only orders (basis points).

- Type: Integer

- Default:

10(0.10%) - TOML Path:

risk.limit_price_offset_bps - Example:

WEALTH__RISK__LIMIT_PRICE_OFFSET_BPS=15

How it works:

- Buy orders: Place at

market_price × (1 - offset_bps/10000) - Sell orders: Place at

market_price × (1 + offset_bps/10000)

WEALTH__RISK__POST_ONLY_RETRY_COUNT

Number of retry attempts when post-only order is rejected.

- Type: Integer

- Default:

3 - TOML Path:

risk.post_only_retry_count - Example:

WEALTH__RISK__POST_ONLY_RETRY_COUNT=5

Retry Logic:

- Post-only order placed at calculated price

- If rejected (would cross spread), price adjusted deeper into book

- Repeat up to

post_only_retry_counttimes - If all retries fail and

market_order_fallback_enabled=true, fall back to market order

Fee Savings Example:

| Exchange | Maker Fee | Taker Fee | Savings per $10k Trade |

|---|---|---|---|

| Binance VIP 0 | 0.02% | 0.05% | $3.00 |

| Bybit Regular | 0.02% | 0.055% | $3.50 |

| HyperLiquid Tier 0 | 0.015% | 0.045% | $3.00 |

Trailing Stop Configuration

Note: Trailing stop configuration is defined in config.toml or via environment variables below.

WEALTH__RISK__TRAILING_STOPS_ENABLED

Enable trailing stop loss functionality.

- Type: Boolean

- Default:

true - TOML Path:

risk.trailing_stops_enabled - Values:

true|false - Example:

WEALTH__RISK__TRAILING_STOPS_ENABLED=true

WEALTH__RISK__TRAILING_STOP_ACTIVATION

Profit threshold to activate trailing stop (as decimal percentage).

- Type: Decimal (0.0-1.0)

- Default:

0.03(3%) - TOML Path:

risk.trailing_stop_activation - Example:

WEALTH__RISK__TRAILING_STOP_ACTIVATION=0.05

WEALTH__RISK__TRAILING_STOP_DISTANCE

Maximum allowed profit retracement before exit (as decimal percentage).

- Type: Decimal (0.0-1.0)

- Default:

0.40(40% from peak) - TOML Path:

risk.trailing_stop_distance - Example:

WEALTH__RISK__TRAILING_STOP_DISTANCE=0.3

WEALTH__RISK__TRAILING_STOP_MIN_LOCK

Minimum profit to lock in (prevents exit below this level).

- Type: Decimal (0.0-1.0)

- Default:

0.02(2%) - TOML Path:

risk.trailing_stop_min_lock - Example:

WEALTH__RISK__TRAILING_STOP_MIN_LOCK=0.015

WEALTH__RISK__SLIPPAGE_AWARE_EXITS

Consider estimated slippage cost in exit decisions. When enabled, positions with remaining potential profit less than expected closing costs may be held for one more funding period.

- Type: Boolean

- Default:

true - TOML Path:

risk.slippage_aware_exits - Example:

WEALTH__RISK__SLIPPAGE_AWARE_EXITS=false

Fee Configuration

WEALTH__RISK__FEES__ESTIMATED_SLIPPAGE

Estimated slippage for market orders (as decimal).

- Type: Decimal (0.0-1.0)

- Default:

0.001(0.1%) - TOML Path:

risk.fees.estimated_slippage - Example:

WEALTH__RISK__FEES__ESTIMATED_SLIPPAGE=0.002

Exchange Fee Overrides

Override default exchange fee rates in config.toml under [risk.fees.<exchange>]:

Binance

[risk.fees.binance]

maker = 0.0002 # 0.02% - Maker fee

taker = 0.0004 # 0.04% - Taker fee

funding_interval_hours = 8

Bybit

[risk.fees.bybit]

maker = 0.0001 # 0.01% - Maker fee

taker = 0.0006 # 0.06% - Taker fee

funding_interval_hours = 8

HyperLiquid

[risk.fees.hyperliquid]

maker = 0.0000 # 0.00% - Maker rebate

taker = 0.00035 # 0.035% - Taker fee

funding_interval_hours = 1 # HyperLiquid uses hourly funding (24x daily)

Note: HyperLiquid processes funding every hour, unlike most CEXes which use 8-hour intervals. This affects EV calculations and provides more frequent profit collection opportunities.

Aster

[risk.fees.aster]

maker = 0.0002 # 0.02% - Maker fee

taker = 0.0005 # 0.05% - Taker fee

funding_interval_hours = 4 # Aster uses 4h or 8h per-symbol (fetched dynamically)

Note: Aster funding intervals vary by symbol (4h or 8h). The bot automatically fetches per-symbol intervals via the API and caches them. The config value is a fallback only.

Instrument Discovery Configuration

Dynamic pair discovery settings for automatic symbol detection (v0.30+). These settings control how the bot discovers and manages trading pairs from external sources like Loris.tools.

WEALTH__INSTRUMENT_DISCOVERY__USE_LORIS_RANKINGS

Enable Loris.tools-based pair discovery for top funding rate opportunities.

- Type: Boolean

- Default:

false - TOML Path:

instrument_discovery.use_loris_rankings - Example:

WEALTH__INSTRUMENT_DISCOVERY__USE_LORIS_RANKINGS=true - Prerequisite: Requires

enabled = trueor--discoverCLI flag

WEALTH__INSTRUMENT_DISCOVERY__REFRESH_INTERVAL_HOURS

Periodic refresh interval for Loris.tools pair discovery (hours, 0 = disabled).

- Type: Integer (hours)

- Default:

0(disabled - discovery runs only at startup) - TOML Path:

instrument_discovery.refresh_interval_hours - Example:

WEALTH__INSTRUMENT_DISCOVERY__REFRESH_INTERVAL_HOURS=6 - Prerequisite: Requires

use_loris_rankings = trueand discovery enabled

Behavior:

- When

> 0: Periodically queries Loris.tools API to discover new high-opportunity pairs - Add-only strategy: New pairs are added automatically; pairs with active positions are never removed

- Jitter protection: Random 0-30 minute delay added to prevent synchronized API requests across multiple bot instances

- WebSocket integration: Automatically registers new pairs with price and funding rate streams

When to Enable:

| Scenario | Recommended Value |

|---|---|

| Long-running production bot that should adapt to market changes | 6 (6 hours) |

| Short-term trading sessions or manual pair management | 0 (disabled) |

| Stable, predictable instrument sets preferred | 0 (disabled) |

Note: The instrument list may grow over time with add-only logic. Use hot-reload config changes to manually prune symbols if needed.

WEALTH__INSTRUMENT_DISCOVERY__MAX_SYMBOLS

Maximum number of symbols to discover from Loris.tools rankings.

- Type: Integer

- Default:

20 - TOML Path:

instrument_discovery.max_symbols - Example:

WEALTH__INSTRUMENT_DISCOVERY__MAX_SYMBOLS=30

WEALTH__INSTRUMENT_DISCOVERY__ENABLED

Enable dynamic pair discovery (requires both config and CLI flag for safety).

- Type: Boolean

- Default:

false - TOML Path:

instrument_discovery.enabled - Example:

WEALTH__INSTRUMENT_DISCOVERY__ENABLED=true

When enabled, the bot discovers trading pairs automatically instead of using static [[instruments]] configuration. Requires double opt-in: set enabled = true in config AND use --enable-discovery CLI flag.

WEALTH__INSTRUMENT_DISCOVERY__EXCHANGES

Exchanges to use for pair discovery. If empty, all exchanges with credentials are used.

- Type: Array of strings

- Default:

[](all available exchanges) - TOML Path:

instrument_discovery.exchanges - Example:

WEALTH__INSTRUMENT_DISCOVERY__EXCHANGES=binance_futures,hyper_liquid

Options: binance_futures, bybit_perpetuals_usd, hyper_liquid

WEALTH__INSTRUMENT_DISCOVERY__MIN_24H_VOLUME_USD

Minimum 24-hour trading volume in USD for discovered pairs.

- Type: Integer (USD)

- Default:

1000000($1M) - TOML Path:

instrument_discovery.min_24h_volume_usd - Example:

WEALTH__INSTRUMENT_DISCOVERY__MIN_24H_VOLUME_USD=5000000

Higher values select more liquid pairs with lower slippage. Recommended range: $1M-$10M depending on position sizes.

WEALTH__INSTRUMENT_DISCOVERY__QUOTE_ASSET

Quote asset filter for discovered pairs.

- Type: String

- Default:

USDT - TOML Path:

instrument_discovery.quote_asset - Example:

WEALTH__INSTRUMENT_DISCOVERY__QUOTE_ASSET=USDC

Options: USDT, USDC, BUSD

WEALTH__INSTRUMENT_DISCOVERY__EXCLUDE

Symbols to exclude from discovery (substring matching, case-sensitive).

- Type: Array of strings

- Default:

["BULL", "BEAR", "UP", "DOWN", "HEDGE", "DEFI"] - TOML Path:

instrument_discovery.exclude - Example:

WEALTH__INSTRUMENT_DISCOVERY__EXCLUDE=BULL,BEAR,SHIB

Use to manually block leveraged tokens, sector baskets, or specific pairs. Example: "BULL" matches "BULLISH", "BULLUSDT", "ETHBULL".

WEALTH__INSTRUMENT_DISCOVERY__MIN_EXCHANGES

Minimum number of exchanges that must support a symbol for it to be discovered.

- Type: Integer

- Default:

2 - TOML Path:

instrument_discovery.min_exchanges - Example:

WEALTH__INSTRUMENT_DISCOVERY__MIN_EXCHANGES=3

Ensures arbitrage is possible (need at least 2 exchanges). Set higher to only trade pairs available on 3+ exchanges.

WEALTH__INSTRUMENT_DISCOVERY__LORIS_SORT_BY

Sorting strategy when using Loris.tools API for discovery.

- Type: String

- Default:

arbitrage - TOML Path:

instrument_discovery.loris_sort_by - Example:

WEALTH__INSTRUMENT_DISCOVERY__LORIS_SORT_BY=oi_rank